Unknown Facts About 10 Steps to Be Debt-Free in Less Than a Year - AARP

The Shocking Truth About Debt: It's Not A Financial Problem

Facts About Navient - Education Loan Management and Business Uncovered

Do you have excessive financial obligation for your income? Inspect now! Credit counseling helps you determine the best choice from a variety of alternatives Certified credit therapists have the knowledge and knowledge you need to discover a service. They work for nonprofit agencies that exist exclusively to assist people get out of financial obligation.

Even better, a credit counseling consultation is free, so you won't sustain another costs to discover your course to flexibility. Infographic Learn what to anticipate when you take the plunge into credit therapy, so you can discover the course forward to attain liberty from charge card debt. Speak with a certified credit counselor totally free now to discover the best service for your distinct financial situation.

It generally rolls several financial obligations into a single consolidated repayment schedule. The credit counselor helps you find a payment that works for your budget plan. Then they work out with your financial institutions to reduce or remove your rate of interest, along with stop any future charges. Licensed credit therapists that work for nonprofit recognized firms just suggest this if it's the very best option for your scenario.

COVID-19 has burdened many with debt, but one solution is under attack in NC.

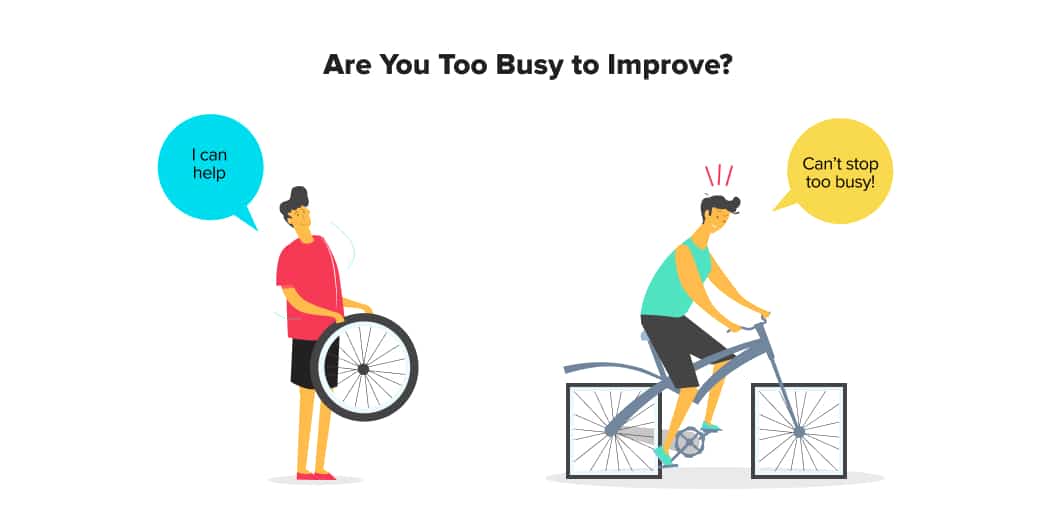

A financial obligation management program works even if you have bad credit or excessive financial obligation to settle utilizing other services. As Go Here For the Details as you have earnings to make the single month-to-month payment, you normally qualify. This video provides one example of how a debt management program assisted somebody get out of debt: View Records "Do you use credit cards to "get by" when you don't have adequate cash? Narrator: Individuals frequently utilize credit cards to make ends meet when they have a minimal capital.

The Main Principles Of NFCC Nonprofit Free Credit and Debt Advice

Renee amassed over $19,000 in charge card debt. For Renee, managing on charge card during graduate school put her on a treadmill of debt. Her credit card interest rates were in between 15-20%. She was shelling out over $1,200 a month to her lenders however getting no place fast 'On-screen quote from Renee' "I talked with a couple of companies initially.

Financial Obligation Management Program: Before $1,200 monthly; After $500 per month! The program lowered her overall monthly payments by nearly 60 percent. 'On-screen quote from Renee' "The experience of living without charge card actually altered my mindset. It changed how I budget plan and spend my cash now. The month-to-month cost savings indicated she didn't require charge card to get by any longer, since her budget plan was stabilized.